Italmatch 25th anniversary – The Successful Journey between Italmatch and Private Equity (1998-2023)

Italmatch's first 25 years were marked by economic results and valuable collaborations with private equity funds

Communications Office

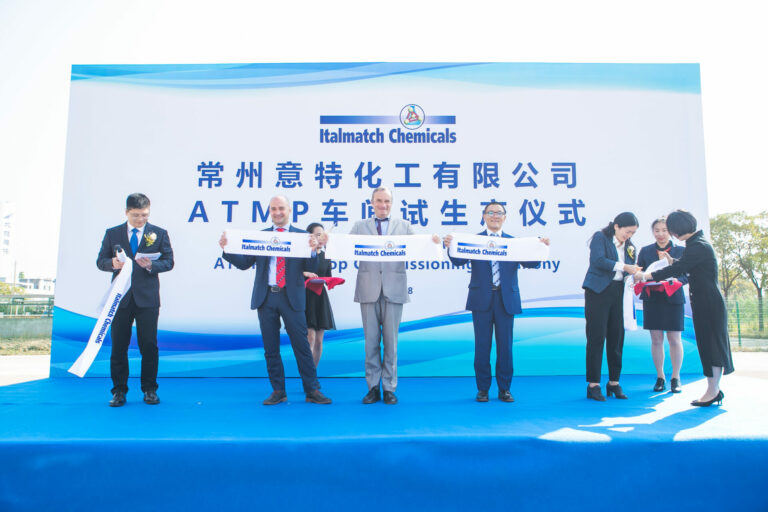

In case you missed it, read the article about Italmatch Chemicals latest projects in China by clicking the button below:

The history of a company consists not only of entrepreneurial intuitions, R&D, M&A, greenfields, diversification of products and growth in sales, but for the most virtuous ones it is also an economic adventure, in the most intrinsic meaning of the word. A concept that the Greeks summarized by the crasis of the words oikos (house) and nomos (law) and literally indicated governance of the house or governance of the family. The more purely financial aspects are located in a broader framework, where each investment and each acquisition corresponds to a motivation of more general meaning and direction. Just like in a family, where sharing values and objectives governs every single action.

This has been the case for Italmatch Chemicals since its foundation, which took place, as already mentioned in the first chapter, thanks to a Management Buyout operation in which few managers acquired the chemical branch of the SAFFA Group, where they worked until then.

The operation required the support of a pool of investors, led by Gustavo Denegri (who was also the first president of Italmatch Board of Directors) and his Iniziativa Piemonte, today Industria e Finanza and with them Alessandro Benetton‘s and Andrea Bonomi‘s 21 Invest and a group of banks headed by Crédit Agricole. Looking at it today, when Italmatch is a leading international company, the operation might seem like a logical and low-risk investment.

The secondary buyout

In 1997 the first MBO firmly believed in an industrial model still to be built and which was based on the Spoleto plant as its only assets and phosphorus as the only chemistry. That’s why this was the first example of a vision of economy as consisting not only of budgets and turnover, but above all of sharing a method and union of intent. The financial structure remained unchanged until the beginning of the new millennium, when Argos Soditic Italia, a closed-end fund under foreign law, entered the capital with a 45% stake jointly with Iniziativa Piemonte that strongly continued to believe in the future growth. At the same time, the involvement of senior management in the company’s shareholding was strengthened, through a 10% stake.

The new structure, thanks in particular to the industrial credibility of Iniziativa Piemonte, to its founder Gustavo Denegri and the enthusiasm of Sergio lorio, leading the MBO, facilitated the implementation of a new growth plan which decisively took the path of joint ventures in China, the main producing country of that yellow phosphorus which was Italmatch’s core business in the early years.

Each new entry of private equity contributed not only to new investments that strengthened Italmatch presence on the market, but also to cultural development. From governance to projects to improve the safety and environmental profile of the group’s offices. During these first eight years from its birth, Italmatch Chemicals doubled its sales and tripled its profitability in terms of industrial operating margin, thus showing itself to be more than ready for the next transition, which occurred in 2004, when the company was the subject of a new buyout (a so-called secondary buyout) through which the shareholders sold their entire shareholdings, equal to 90%, to a new institutional investor: Andrea Bonomi‘s Investindustrial fund.

Investindustrial

The further change in structure coincided with a new industrial season for Italmatch, which had the ability to build a research, development and innovation team with focus on chemical applications, and at the same time began to develop global partnerships destined to last over time with a number of large multinationals. It is also worth underlining here that during that period Italmatch was not yet the structured reality that it is today. More than its numbers, therefore, what distinguished the company was its ability to be a flexible partner, ready to adapt to customer requests and able to provide added value on certain raw materials or critical intermediate products. The Investindustrial period was a fundamental step in which Italmatch changed gear at industrial level, thanks above all to the acquisition of the Arese site from Akzo Nobel.

Mandarin Capital

Italmatch was thus more than prepared for the next handover, with a consolidated turnover of 90 million Euros and an Ebitda of 22 million. The operation took place in 2010 and was conducted by the Italian-Chinese private equity fund Mandarin Capital Partners. Through Mandarin’s relationships in China, Italmatch leveraged to achieve growth and presence in Far East, nurturing skills from local to global, as Enrico Ricotta pointed out.

Also in this case, some managers of the company also participated in the creation of the new company that took over Italmatch via an operation worth around 100 million Euros, with a minority share, while the majority of the shares went to the Mandarin fund led by Enrico Ricotta. It is no coincidence that, with the support of the new shareholders, the intentions were to enhance production in China and build its own factory (in Nantong), and then complete the geographical positioning of the company through M&A also towards the West and landing in the United States.

Change management – Phase 2

Following the acquisition of Dequest–Thermphos, a reinforcement plan was launched at the Genoa headquarters with the arrival of some managers for the new Change Management: Daniela Battistelli (ICT), Nicola Zumiani (Corporate Finance), Anna Zhukovskaya (Treasury), Arturo Carchio (M&A-IR), Jessica Marchi (Finance), Riccardo Di Giovanni (Controller), perfectly integrated with Laura Andrei, Marco Magnano, Nicola Valentino (GRS).

“SAP, BOND, IFRS, M&A, some of the new challenges won! A big thank you to this Dream Team of excellence”, says Maurizio Turci.

The Ardian years

It wasn’t a long wait for America, but instead arrived after the further corporate transition, which occurred in 2014 with the entry of the Ardian fund, one of the main independent private investment companies, founded in 1996 and led by Dominique Senequier, with assets amounting to 47 billion dollars managed in Europe, North America and Asia.

The new investors acquired the entire capital of Mandarin, equal to 88%, and that of the Malacalza family, while the senior management of Italmatch maintained its 12% share. For Ardian it was the fourth investment intially through funds active in the Mid Cap segment. A company that had grown exponentially in the years preceding the acquisition, but which still had excellent opportunities that Ardian could help develop. On the other hand, Italmatch Chemicals strategy was to quickly become a global player in innovative and high-tech sectors, thanks to its ability to innovate and develop new eco-sustainable products and special additives.

During the years of Ardian management, through the leadership of Nicolò Saidelli and Yann Chareton, Italmatch continued its development strategy by expanding both the product range and the markets, in particular in the business of water treatment, oil & gas and high-performance lubricants for industrial applications, as well as strengthening its presence in the area, with the opening or acquisition of new factories.

The cherry on the pie in those lucky years, Italmatch moved its headquarters from the WTC in the old industrial area to the modern “Cotton Warehouses”, overlooking the iconic Porto Antico in the center of Genoa, an area designed by Renzo Piano. This change was in line with the group’s growth process, which also had the strategic aim of facilitating and improving relationships, both internal and external, offering more innovative and efficient structures but remaining in the heart of the Ligurian capital to which Italmatch has been linked since the years immediately following its foundation.

Covid and Solidarity Fund

Combining a global presence with the respect and appreciation for local people, whose enthusiasm, loyalty and entrepreneurial spirit have always been the real driving force behind Italmatch’s growth. Proof of this is the Solidarity Fund, launched by CEO and GM, to which the entire organization has contributed with voluntary salary reduction. This and other initiatives for workers’ and employees’ safety, SW and economic incentives have led Italmatch to receive the Class Editori “Solidarity Leader” award. “We cannot forget the professionalism and generosity of all our colleagues. We will continue to look at the factory workers with respect: they were the ones who did the hardest work at the time”, Maurizio Turci recalls.

Global player with Bain Capital and Dussur

The story of investments and private equity had not yet come to an end. After four years – in which with the shareholder Ardian, Italmatch had again more than doubled its turnover, reaching 400 million, and completed nine acquisitions throughout the world, totaling 17 factories and 780 employees in Europe, the United States and China – in 2018 the leading global investment company Bain Capital Private Equity stepped forward.

Founded in 1984 and protagonist of over 760 investments up to that point, with assets managed for a total of approximately 95 billion dollars, Bain Capital positioned itself as the ideal partner to support Italmatch further phase of its growth. Similarly, Bain Capital Private Equity, thanks to its experience in the chemical sector brought by David Danon, and its global presence, was ready to support the Italian company both organically and through an ambitious plan of strategic acquisitions, as declared by Bain’s Managing Director, Ivano Sessa.

The entry of Bain Capital was completed with the issue of a bond which allowed Italmatch to open to external investors for the first time since its foundation. By now, the fortunate definition of “pocket multinational” coined by Maurizio Turci, perfect for the first 20 years of Italmatch life, was beginning to be closer to a reality whose rapid growth path knew no bounds and was also beginning to envision a possible future listing on the Stock Exchange.

The definition actually became completely anachronistic in the following four years, which not only saw Italmatch more than double its Ebitda, increasing from 67 million Euros in 2018 to 142 million in 2022, but also opened up to a new, further participation which took place in 2023, with the entry into the capital of the Saudi Arabian industrial investment company Dussur, in addition to new managers’ investments. Dussur, part of the Sovereign fund PIF, in addition to acquiring a minority share of just under 20%, also invested a further sum of 100 million Euros as a capital increase.

The operation was particularly significant in strengthening Italmatch’s presence in the Middle East and Saudi Arabia, contributing to regional economic diversification and making Dussur itself take “a step forward towards fulfilling our mandate to locate new capabilities within the Kingdom”, as stated by its CEO, Raed Al-Rayes. “Italmatch represents for Saudi a “pot” of interesting technologies for localization in the Kingdom”, continued Dussur CEO. On the other hand, the Middle East and Saudi Arabia in particular are the new frontiers of an increasingly fundamental business for Italmatch: one that looks at green chemistry and, more generally, at ESG (environmental, social and governance) criteria and categories, in one of the future expected highest growth countries.